Stage Door Society

Kravis Center Membership

Introducing the Stage Door Society, our new membership program.

When you join the Stage Door Society, your annual commitment fuels extraordinary performances, expands transformative arts education, and strengthens the cultural heartbeat of our community. We invite you to take your place among the supporters whose vision ensures the Kravis Center continues to inspire, engage, and uplift, now and for the future.

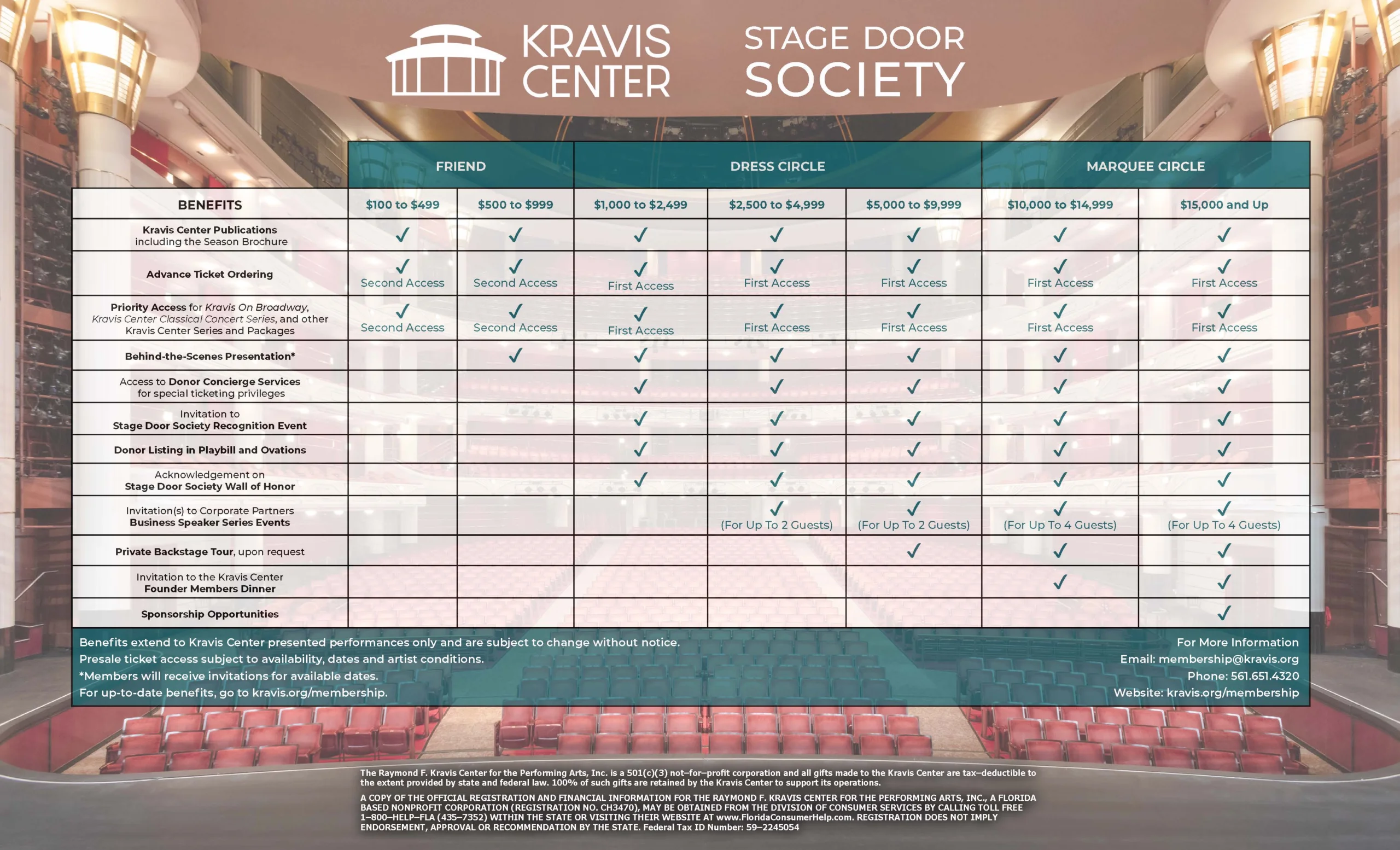

ANNUAL MEMBERSHIP LEVELS & BENEFITS

$100 to $499

Annual Friend Members receive the following benefits:

–Kravis Center Publications, including the Season Brochure

–Kravis Center Presentations (second access)

–Advanced Access to tickets for Kravis On Broadway, Kravis Center Classical Concert Series, and other Kravis Center Series and Packages prior to the Public (second access)

$500 to $999

Friend Members at this level receive the above benefits plus:

-Invitations to Behind-the-Scenes Presentation (Members will receive invitations for available dates.)

$1,000 to $2,499

–Kravis Center Publications, including the Season Brochure

–First Access to tickets for Kravis Center presentations

–First Access to tickets for Kravis On Broadway, Kravis Center Classical Concert Series, and other Kravis Center Series and Packages

-Access to Donor Concierge Services for special ticketing privileges including complimentary ticket exchange

-Invitation to Stage Door Society Recognition Event

–Donor listing in Playbill and Ovations

-Acknowledgement of support on Stage Door Society Wall of Honor

$2,500 to $4,999

All benefits previously listed, plus the following:

-Invitation to Corporate Partners Business Speaker Series presentations (up to 2 guests)

$5,000 to $9,999

All benefits previously listed, plus:

–Private Backstage Tour, upon request

$10,000 to $14,999

–Kravis Center Publications, including the Season Brochure

–First Access to tickets for Kravis Center presentations

–First Access to tickets for Kravis On Broadway, Kravis Center Classical Concert Series, and other Kravis Center Series and Packages

-Access to Donor Concierge Services for special ticketing privileges including complimentary ticket exchange

-Invitation to Stage Door Society Recognition Event

–Donor listing in Playbill and Ovations

-Acknowledgement of support on Stage Door Society Wall of Honor

-Invitation to Corporate Partners Business Speaker Series presentations (up to 4 guests)

–Private Backstage Tour, upon request

-Invitation to Kravis Center Founder Members’ dinner

$15,000 to $24,999

All benefits previously listed, plus the following:

Sponsorship Opportunities may include the following:

–Complimentary tickets to sponsored performance (not tax-deductible)

–Recognition of sponsorship in available promotional materials and advertisements, including radio, website, television, Playbill, Ovations, and newspapers

-Day/Night of sponsorship digital signage recognition in the Carl & Ruth Shapiro Founders’ Room, on the Stage Door Society Wall of Honor, and in Dreyfoos Hall Lobby

-Opportunity to meet the artist of sponsored performance (subject to artist availability)

$25,000 to $49,999

All benefits previously listed, plus the following:

–Invitation to the Carl & Ruth Shapiro Founders’ Room for one performance

Benefactors and Grand Benefactors play a vital role in advancing our mission, providing transformative annual support that strengthens every corner of our organization. Their generosity stands at the highest level of giving, offering unmatched impact and recognition.

Benefactor – $50,000 to $99,000

Grand Benefactor – $100,000 and Up

Benefits extend to Kravis Center presented performances only and are subject to change without notice.

Presale ticket access subject to availability, dates and artist conditions.

ADDITIONAL MEMBERSHIP OPPORTUNITIES

As a Founder member with a commitment of $150,000, you will have access pre-performance and during intermission to the exclusive Carl & Ruth Shapiro Founders’ Room in addition to many other benefits tailored to your personal objectives. To learn more, call the Development Department at 561.651.4320.

Kravis Center Corporate Partners is comprised of corporate and professional leaders in Palm Beach County whose mission is to support and enable the Kravis Center to continue its extensive educational and community outreach programs. Corporate Partner membership offers this dynamic group of business leaders the opportunity to act as an integral part of the Kravis Center, building awareness of the Center within the business community.

The Young Professionals of the Kravis Center is a group of philanthropic minded individuals, ages 49 and under, who support the mission of the Kravis Center.

Give a gift of membership to celebrate an important or memorable occasion or a special thank you. You will receive the tax deduction and the recipient will receive the annual membership with all the associated benefits.

Thank you for your consideration of support. For additional information about Kravis Center membership, contact the Development Office at 561.651.4320 or [email protected].

ALREADY A MEMBER? RENEW NOW!

OTHER WAYS TO GIVE

Your charitable gift may qualify for a tax deduction.

If you have a loved one who has been impacted by the Kravis Center for the Performing Arts, establishing a memorial or tribute gift is a meaningful way to honor them or celebrate a special occasion, such as a birthday, while supporting our mission. Your memorial or tribute gift will extend the legacy of your loved one and will make a difference.

Gift “In Honor Of”

Give a gift “in honor of a special friend, family member or an important or memorable occasion. The gift is 100% tax-deductible and an acknowledgment will be sent to the honoree.

Gift “In Memory Of”

Give a gift to honor a loved one. Your gift is 100% tax-deductible.

A Tax-Savvy Way to Benefit from Growing Assets

Securities and mutual funds that have increased in value and been held for more than one year are popular assets to use when making a gift to the Kravis Center for the Performing Arts. Making a gift of securities or mutual funds offers you the chance to support our work while realizing important benefits for yourself.

When you donate appreciated securities or mutual funds in support of the Kravis Center for the Performing Arts, you can reduce or even eliminate federal capital gains taxes on the transfer. You may also be entitled to a federal income tax charitable deduction based on the fair market value of the securities at the time of the transfer.

Securities are most often used to support our work in the form of:

An outright gift. When you donate securities to the Kravis Center, you receive the same income tax savings that you would if you wrote a check, but with the added benefit of eliminating capital gains taxes on the transfer, which can be as high as 20%.

A transfer on death (TOD) account.* By placing a TOD designation on your brokerage or investment account, that account will be paid to one or more persons or charities after your lifetime.

*State laws govern transfer on death accounts. Please consult with your bank representative or investment advisor if you are considering this gift.

Smart Giving From Your IRA

Make a difference today and save on taxes. It is possible when you support the Kravis Center for the Performing Arts through your IRA.

You can give any amount (up to a maximum of $108,000) this year from your IRA directly to a qualified charity such as the Kravis Center for the Performing Arts without having to pay income taxes on the money. Gifts of any value $108,000 or less are eligible for this benefit and you can feel good knowing that you are making a difference at the Kravis Center for the Performing Arts. This popular gift option is commonly called the IRA charitable rollover, but you may also see it referred to as a qualified charitable distribution, or QCD for short.

Simplify Your Giving

A donor advised fund (DAF), which is like a charitable savings account, gives you the flexibility to recommend how much and how often money is granted to the Kravis Center for the Performing Arts and other qualified charities. You can recommend a grant or recurring grants now to make an immediate impact or use your fund as a tool for future charitable gifts.

You can also create a lasting legacy by naming the Kravis Center for the Performing Arts the beneficiary of the entire account or a percentage of the fund. With a percentage, you can create a family legacy of giving by naming your loved ones as your successor to continue recommending grants to charitable organizations. Contact your fund administrator for a beneficiary form.

Did you know your membership benefits could possibly be increased by your employer? Many businesses, from small companies to large corporations, have a matching gift program. You enjoy more member privileges while the Kravis Center receives additional funds to further our mission. Ask your employer if they would like to participate.

Your Gift Can Last Forever

An endowment gift to the Kravis Center for the Performing Arts today provides a brighter future at the Kravis Center for the Performing Arts. When you make a donation to an endowment, you give a gift with both immediate and long-term benefits.

Endowment donations are invested. A portion of the annual income from the investment is used to address immediate needs at the Kravis Center for the Performing Arts. The remaining funds are reinvested to ensure indefinite support.

The Kravis Center for the Performing Arts considers the personal information of its donors and our performance ticket buyers to be proprietary. It is the Center’s policy to not provide, share or sell this information to other organizations nor send donor solicitation mailings on behalf of other organizations.

This policy applies to our master file database of donors, prospects, ticket purchasers, volunteers, employees and other promotional materials mailing lists. This policy includes all personal information including physical and e-mail addresses and applies to all information collected either via our website or directly from the donors and patrons.

The Raymond F. Kravis Center for the Performing Arts is a 501(c)(3) not-for-profit corporation and all gifts made to the Center are tax-deductible to the extent provided by state and federal law. 100% of such gifts are retained by the Center to support its operations. A COPY OF THE OFFICIAL REGISTRATION AND FINANCIAL INFORMATION FOR THE RAYMOND F. KRAVIS CENTER FOR THE PERFORMING ARTS, INC., A FLORIDA BASED NONPROFIT CORPORATION (REGISTRATION NO. CH3470), MAY BE OBTAINED FROM THE DIVISION OF CONSUMER SERVICES BY CALLING TOLL FREE 1-800-HELP-FLA (435-7352) WITHIN THE STATE OR VISITING THEIR WEB SITE AT www.FloridaConsumerHelp.com. REGISTRATION DOES NOT IMPLY ENDORSEMENT, APPROVAL OR RECOMMENDATION BY THE STATE. Federal Tax ID Number: 59-2245054